The OBBB Era: How 48E, 45Y, and New Rules Are Reshaping Solar in the U.S.

- Sanjay Bhatia

- Aug 31, 2025

- 4 min read

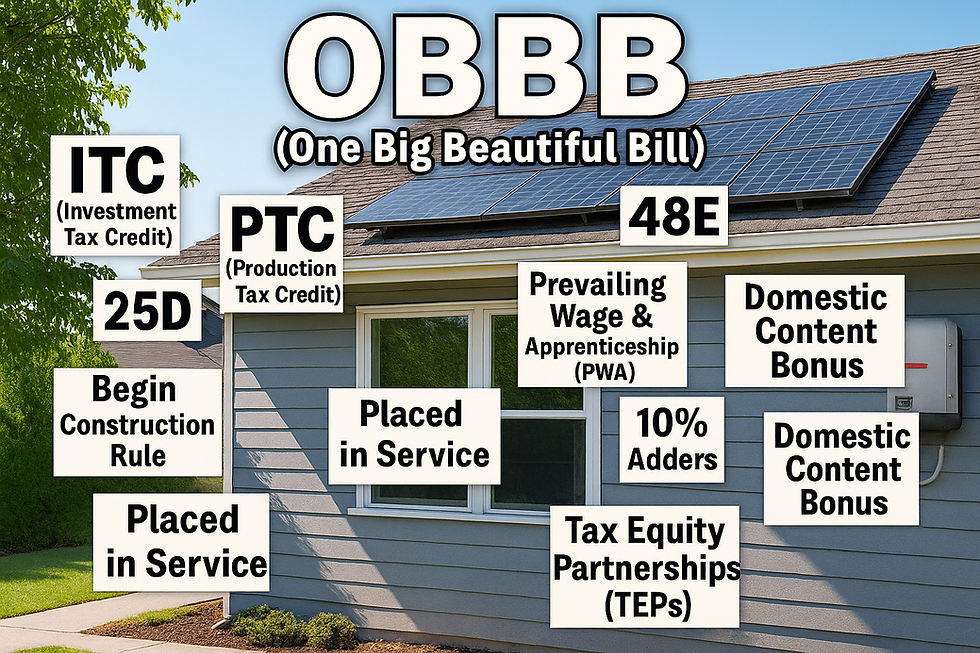

The U.S. solar industry is undergoing a historic shift due to the passage of the One Big Beautiful Bill Act (OBBB) and its reshaping of tax incentives, project deadlines, and investment dynamics. Whether you're a residential installer, C&I developer, or tax equity investor, the landscape is evolving fast — and so must your strategy.

This blog distills the core changes across residential and commercial segments, with guidance on how companies can survive and thrive beyond 2025, leveraging VPPs, DERMS, TPO models, battery integration, and more.

Residential Solar: The 25D Cliff and What Comes Next

25D Credit Expiring December 31, 2025

30% ITC for homeowners disappears entirely after 2025 with no phase-out.

Originally intended to phase out gradually through 2034, OBBB accelerates the end.

This has triggered a surge in demand for 2025 installations, creating a bottleneck for permitting, procurement, and labor.

Strategic Response:

Push to close projects NOW: Homeowners must have systems installed and operational by year-end 2025.

Installers are racing to secure components (panels, inverters, racking) and manpower before timelines close.

Financing adaptation: Loans are being restructured to move away from ITC dependency and emphasize lifetime value over monthly savings.

Commercial & Industrial: Navigating 48E and 45Y

48E – Investment Tax Credit (ITC)

Credit calculated as a % of capital investment.

Default 6%, increased to 30% if Prevailing Wage & Apprenticeship (PWA) standards are met.

Projects under 1.5 MW are exempt from PWA- they automatically qualify for the 30% rate.

Optimizers and batteries count toward eligible basis and increase total ITC value.

45Y – Production Tax Credit (PTC)

Long-term credit based on electricity sold.

Ideal for high-capacity-factor projects (e.g., wind, geothermal).

Paid over 10 years.

Feature | 48E (ITC) | 45Y (PTC) |

Credit Timing | Year system is placed in service | 10 years based on electricity output |

Best for | Solar, high upfront costs | Wind/geothermal, consistent output |

Risk Focus | Construction cost risk | Output and operational risk |

Safe Harbor Rules (Commercial <1.5MW)

Safe harbor eligibility preserved if 5% of total project cost is incurred before deadline. Project must meet a "Beginning of Construction" (BOC) standard by July 4, 2025 to avoid an earlier tax credit termination.

Qualifying projects: Solar facilities with a maximum net output of 1.5 megawatts (AC) or less can satisfy the BOC requirement using either the Physical Work Test or the 5% safe harbor.

Place in service: End of 2030. If you establish BOC by July 4, 2026, you must place the project in service by the end of 2030 to claim the tax credits. This is based on the IRS's four-year continuity safe harbor rule.

Foreign Entity of Concern (FEOC) exemption: December 31, 2025. Projects that establish BOC before December 31, 2025, are exempt from the strict new FEOC material sourcing rules that begin in 2026. This provides a strong incentive to safe harbor by the end of 2025 to simplify supply chain compliance.

Domestic Content & OBBB Adders

Projects using U.S.-made panels, racking, batteries can qualify for bonus ITC/PTC adders (+10%).

Developers are securing supply from First Solar, QCells, and U.S. inverter/battery companies to meet thresholds.

Domestic sourcing is no longer just patriotic — it's financially strategic.

Tax Equity and Transferability Trends

Tax Equity Partnerships (TEPs) Under Pressure

Tighter “begin construction” rules = more scrutiny.

IRR expectations have increased, and NPV models are being repriced.

Developers now need independent FMV appraisals, clean documentation, and tighter execution to secure funding.

Transferability Rising

The ability to sell tax credits directly (instead of structuring complex TEPs) is gaining ground, especially for smaller C&I and distributed projects.

Storage, VPPs & DERMS: The Next Phase

Virtual Power Plants (VPPs)

OBBB rewards systems that contribute to grid resilience.

Networked batteries and VPP-ready inverters will attract premium financing.

Battery-only projects with future add-on solar or energy efficiency upgrades are increasingly popular.

DERMS Integration

Distributed Energy Resource Management Systems (DERMS) allow fleets of solar + storage systems to interact with the grid, earning extra revenue through grid services.

Expect more coordination with utilities and aggregators as grid participation becomes a key value lever.

How Installers and Developers Should Prepare

Residential

Push to install before 12/31/2025 to capture 25D credit.

Educate homeowners on TPO (Lease/PPA) options: 30% credit remains through 2027.

Train sales teams on post-ITC messaging: ownership, lifetime ROI, backup power.

Commercial/C&I

Lock in 48E safe harbor by July 2026 via early procurement.

Target <1.5 MW projects to avoid PWA complexity.

Pair storage or design for VPP participation to future-proof assets.

Consider selling credits via transferability for speed and simplicity.

Key Deadlines

Program | Deadline | Notes |

25D Residential Credit | Dec 31, 2025 | No phase-out. Must be operational. |

48E Full ITC Eligibility | Start by July 4, 2026 | For solar & wind. |

48E Placed in Service | Dec 31, 2027 | For projects that began on time. |

PTC (45Y) | Phased based on emissions milestones | Ongoing eligibility. |

Domestic Bonus Adders | Ongoing | Must meet content thresholds. |

Long-Term Outlook

Timeframe | Market Impact |

2025–2026 | Demand surge for residential; commercial rush to safe-harbor. |

2027–2030 | Storage, DERMS, and transferability dominate project design. |

2031+ | Tech-neutral tax system matures; domestic supply chains stabilize. |

Final Thoughts

The One Big Beautiful Bill Act (OBBB) marks a pivotal shift in how solar projects are financed, built, and monetized. The winners will be those who:

Stay compliant with stricter rules.

Adapt financing models to new credit landscapes.

Leverage domestic content and storage integration.

Embrace transferability, VPPs, and DERMS to future-proof their portfolios.

If you're an installer, developer, or investor navigating these changes -> QuantiEdge can help. We're actively advising clients on safe-harbor strategies, credit structuring, storage integration, and tax equity financing across residential and commercial markets.

Reach out at contact@quantiedge.com or message Sanjay Bhatia at sanjay.bhatia@quantiedge.com, if you would like to collaborate or share how you're adapting to this evolving market.

#SolarTaxCredits #OBBB #48E #45Y #CleanEnergy #VirtualPowerPlants #DERMS #EnergyStorage #SolarFinancing #SafeHarbor #DomesticContent

Comments